eBanking Features

Take your banking experience to the next level—explore smart tools, lightning-fast access, and perks you won’t want to miss with True North’s eBanking platform.

Remote Deposit Check

With Remote Deposit you can deposit personal checks safely and securely directly from your smartphone without having to visit a branch or ATM.

- You’ll need True North’s Mobile App.

- Expand the menu at the bottom of the screen and access Deposit.

- Click on Deposit check and follow the prompted instructions.

- You’re done!

- Your check may post immediately or be held in pending status until reviewed.

- You have the ability to see all pending, rejected and posted checks in Deposit History.

Transfer Funds

True North’s eBanking platform offers several different safe and secure ways to transfer money to and from your True North account.

To protect your accounts, daily and monthly limits on the amount that can be transferred do apply. If higher limits are needed, please contact the Member Contact Center at (907) 523-4700 or memberservice@truenorthfcu.org.

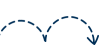

Dashboard

The dashboard provides a quick overview of all your account activity.

- Pin your most-used accounts to the top by clicking the heart icon on their card. Personalize your dashboard by selecting your preferred layout.

- Choose which accounts you want to see by going to your Profile Icon > Settings > Customization > Account Visibility.

- Rename your accounts for easier reference and organization.

- Choose from three color-blind-friendly themes, and adjust the font or language under your Profile Icon > Settings > Customization > Accessibility.

- Your customizations stay in sync across both desktop and mobile devices.

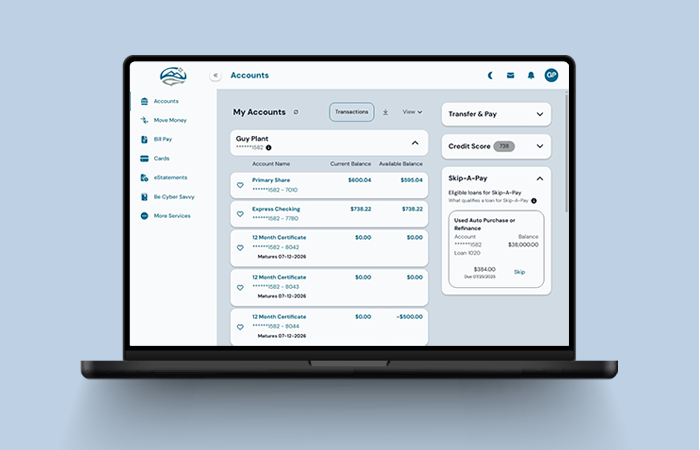

Debit and Credit Card Control

Take charge of your cards with flexible controls—just select 'Cards' from the Main Menu.

- Instantly lock or unlock your card

- Order a replacement card with ease

- Quickly report your card lost or stolen

- Set up travel notices to avoid interruptions