Credit and Lending

Back to Membership Matters Blog

-

Credit Pulls: Hard vs. Soft Inquiries

It’s important to understand who can pull your credit report.

-

Ready, Set, Launch?

Here's an outline of some important steps to take when thinking about starting a new business.

-

Wait Before You Cancel Your Credit Cards

Canceling a credit card may not be a good idea. The reason for that is that keeping a card open can help your credit score in many ways.

-

Your Debt-to-Income Ratio

Your debt-to-income ratio is more than just a number - it's a snapshot of your financial health.

-

Financial Education is on the Rise

The increase in financial education is encouraging because it can help young people make smart money decisions as they get older.

-

4 Ways to Pay Off Debt (That Aren’t Snowball or Avalanche)

While the debt owed by U.S. residents has risen to historic levels, the ability for consumers to pay it off is – you guessed it – also lagging.

-

Thriving in your 30s

It’s never too late to improve your financial future. By setting goals, budgeting, or investing wisely, you can take impactful steps today for a stable tomorrow.

-

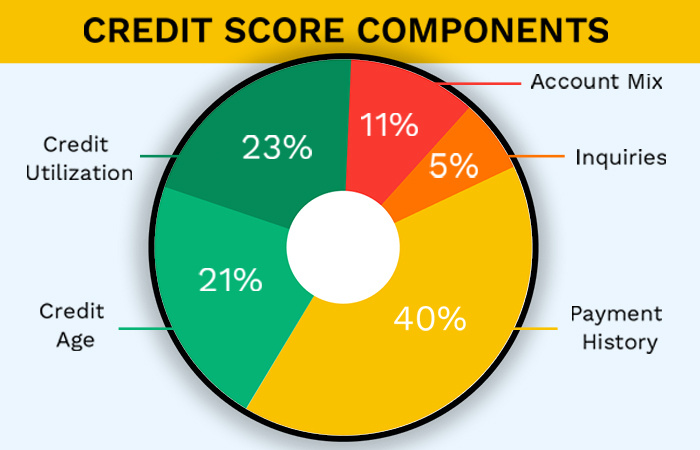

Credit Score Simulator

Keeping tabs on your credit score is essential to good financial health. Score Simulator helps you visualize what your financial health could look like.

-

The Difference Between Delinquency and Derogatory Payments

While no one ever plans to miss a credit card (or other) payment, sometimes we find ourselves in challenging financial situations.

-

What the Difference Between Personal Loans and Debt Consolidation Loans?

Have you wondered, what’s the difference between personal and debt consolidation loans? Well, we’ve got you covered.