Lifestyle

Back to Membership Matters Blog

-

What Is Financial Coaching — and Should You Try It?

A coach guides clients through personal finance, focusing on behavior change, not just education.

-

Money Saving Ideas

Looking for ideas for ways to save money? Almost everyone can find a way to save using at least one of these tips.

-

What to Do with a Year-End Bonus

Smart tips to help you avoid impulsive spending when you receive an extra payment from work.

-

Flexible Spending Funds: Use It or Lose It

If you have a Flexible Spending Account (FSA), the end of the year brings an important deadline you don't want to miss.

-

Credit Pulls: Hard vs. Soft Inquiries

It’s important to understand who can pull your credit report.

-

Ready, Set, Launch?

Here's an outline of some important steps to take when thinking about starting a new business.

-

Taking on the Financial Affairs of a Family Member

Stepping in to becoming a caregiver for someone you love can be meaningful and challenging at the same time, especially when that role also includes taking on their finances.

-

Keep Trick or Treaters Safe this Halloween

Halloween is just days away and kids will soon be out in their neighborhoods for trick or treat fun, here are some tips parents can follow to help keep the kids safe.

-

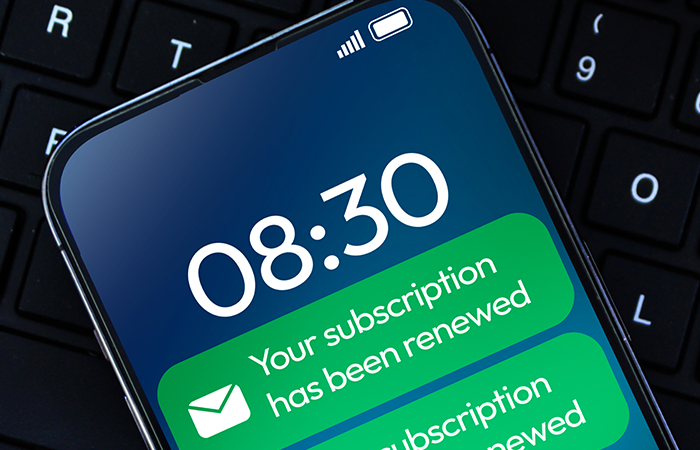

How to Get Out of the Subscription Crunch

One way to get the most out of your budget is to reduce subscription expenses

-

Strategies for Managing Financial Stress and Anxiety

Money stress can be the worst. Sometimes we beat ourselves up for not saving enough or spending too much.